Over the last couple of years, manufacturing growth in North America has been less than stellar, with slow growth and even some contractions in 2024 and mixed results in 2025 as the market confronted a milieu of change. Thankfully, 2026 promises to be better in many ways, driven by capital investments, capacity enhancements, and a leveling out of a market in turmoil.

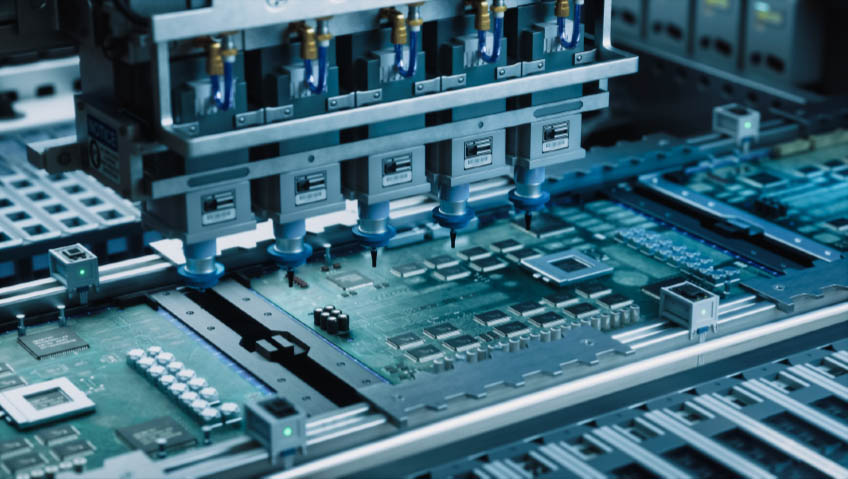

It is no surprise that manufacturing, particularly in North America, has undergone a transformation over the last several years, much of which is being consolidated this year and will lay the foundation for growth in 2026. The growth ahead is expected to be slow to moderate, with mixed sector performance, and with semiconductors, pharmaceuticals and medical devices, clean energy, aerospace, defense, automation, and robotics leading the way.

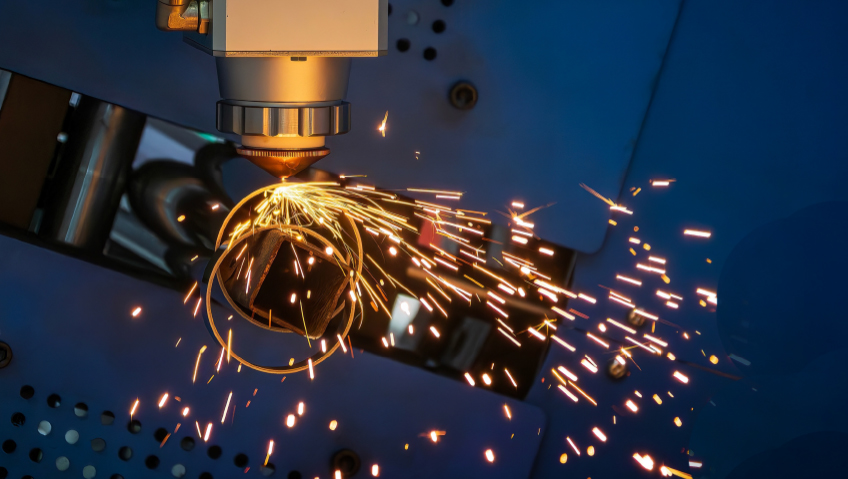

This growth is being driven by the rapid rate of technological advancement that is taking place but is being offset by numerous challenges confronting the industry, including inflationary concerns, supply chain issues, and a dearth of skilled talent that is being exacerbated by the exodus of retirees, which is leaving a skills gap that the sector cannot seem to bridge with technology alone.

There is also the elephant in the room: tariffs. Shifting geopolitical relations have destabilized long-held trade relationships, and inflation paired with the rising costs of inputs like electricity and resources such as steel, aluminum, and softwood lumber (which are subject to tariffs), as well as rising shipping costs, has the market scrambling to bolster domestic supply chains and trade partners.

Tech-enabled change

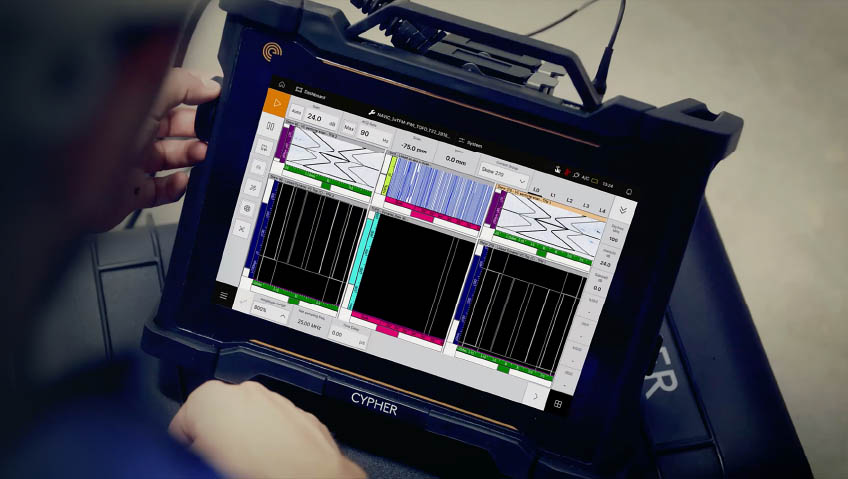

While tariffs and changing trade relationships have left the market in a state of uncertainty, there is one thing manufacturers can count on: technological innovation and integration are key to future strength. This is particularly true in a market where customers have become increasingly discerning and place greater demand on quality, speed, and efficiency, as well as supply chain accountability and real-time transparency.

Smart factories are becoming the standard, wherein technological integration, data analytics, and the IIoT (Industrial Internet of Things) are being leveraged to optimize processes and output—as well as sustainability—in the face of persistent supply chain challenges such as workforce constraints.

2025 saw a greater number of integrated technologies, such as digital twins and generative AI, which will continue into 2026. As greater integration takes place, the value of these investments will be realized on a larger scale as capital investments and mergers and acquisition activity are expected to be robust. Further, in 2026, expect to see increased investment in cybersecurity to protect the investments being made in technology and the data-driven insights it enables, particularly industrial control systems, operating technology and other intellectual property, proprietary information, and sensitive data that can be sabotaged by cyberthreats and theft.

Opportunities and challenges

The rapid rate of innovation and technological advancement has been both a boon and a bane for manufacturers, as it helps to achieve operational efficiencies but also introduces new challenges, chiefly the need for skilled talent and the high capital costs incurred with this kind of investment. Investment in technology is at the heart of capital spending as manufacturers look to integrate and optimize technology and to attract and develop talent that has the skills and qualifications required for its function. There has always been a concern that robots will replace the need for humans, but the truth is that one cannot function entirely without the other.

For instance, collaborative robots, or “cobots” as described by engineering company WiredWorkers, represent one of the more recent iterations of industrial technology in which humans and robots work together, with cobots taking on repetitive or dangerous tasks and human resources being freed to undertake more strategic functions, including those necessary to operate and maintain the cobot.

The fact that manufacturing continues to add jobs demonstrates that there is ongoing demand for talent to complement the investments taking place in technology and infrastructure, and the number of new patents being issued proves that there is strength at the market’s core. Likewise, reskilling and upskilling need to take place to ensure that workers who are being displaced in lagging segments have the opportunity to put their experience to work in a different capacity to address the shortage that continues to threaten optimal productivity.

According to The Manufacturing Institute and Deloitte, the U.S. manufacturing sector alone will need to fill nearly 3.8 million jobs by 2033, and 1.9 million of those jobs could go unfilled if workforce challenges are not addressed.

Talent development requires collaboration between industry, government, and education and takes time to institute the necessary changes, which makes it hard to reactively address changing workforce needs. Sometimes, by the time new programs are instituted and begin to graduate students, the technology has already moved on. Employers are wise to invest equally in training and reskilling programs alongside their technological investment to ensure that they are meeting their own needs for talent internally, rather than waiting for the education system to produce a pipeline of relevantly skilled talent, particularly where there is an acute need for skilled workers and where shortages persist.

Thinking locally in a global economy

While there is no denying the global interconnectedness of the market, current conditions are forcing manufacturers to strengthen not only their supply chains and competitive advantages but also their regional and local ecosystems to mitigate the impacts of matters beyond their control, such as geopolitical uncertainty, supply chain disruptions, and rising costs.

While supply chain resilience has been a focus since the pandemic—which shined a light on the vulnerability of global supply chains—the imposition of tariffs has increasingly forced manufacturers to identify new sourcing agreements and trade partners, with preference for domestic materials and resources where possible. Once again, technology has a role to play, as it is paramount in building agile supply chains, forecasting demand and anticipating challenges, and planning production to adapt quickly to market changes.

Once the impacts of the tariffs are absorbed and prices level out, there will be a better idea of the conditions manufacturers are subject to, at which point there will likely be a wave of greater product diversification and growth. The next challenge will be securing pricing that competes with international players.

What happens in manufacturing also has resounding impacts on other aspects of the economy, such as industrial real estate, which is expected to rebound in 2026 as trade policies level out and monetary conditions ease. Vacancy rates are expected to peak, with larger spaces showing the greatest demand while smaller spaces are expected to be more competitively priced, trends that are expected to stabilize by the end of 2026.

There is strong private sector demand, making the sector attractive to investors who have the capital to support new development opportunities that will come with a new cycle of demand when the current wave of development rounds out. New orders are expected to stabilize in 2026, which will have a resounding impact on the sector as a whole.

Proximity to markets and shipping routes is key to selecting a locale, and behind these decisions are often incentives such as tax breaks, subsidies, training support, and infrastructure investments that encourage the growth and competitiveness of the sector and help manufacturers achieve high-quality goods at lower costs that improve their competitiveness in local and global markets alike.

According to Safeguard Global, “When evaluating manufacturing environments and making location decisions, businesses should consider the five dimensions: policies and regulations, tax policy, costs, workforce quality, and infrastructure and innovation.”

Cautious optimism

After a couple of difficult years, 2026 promises a return to optimism as manufacturers position themselves strategically to optimize the function and output of their operations as much as possible in the wake of inflationary pressures and geopolitical uncertainty.

Like two sides of a coin, the inverse of challenge can be opportunity, and out of the flames the phoenix will fly. There is cautious optimism that the changes being implemented and the investments being made will pay off, especially where government support and incentives exist.

Strategic investment is going to continue to be a key component of manufacturing success, and many considerations must be made in order to optimize efficiency and maximize output and profitability in a highly competitive market. When the dust settles, the market should return to strength, though it still has a way to go to reach peak performance in the face of the countless challenges it is up against.