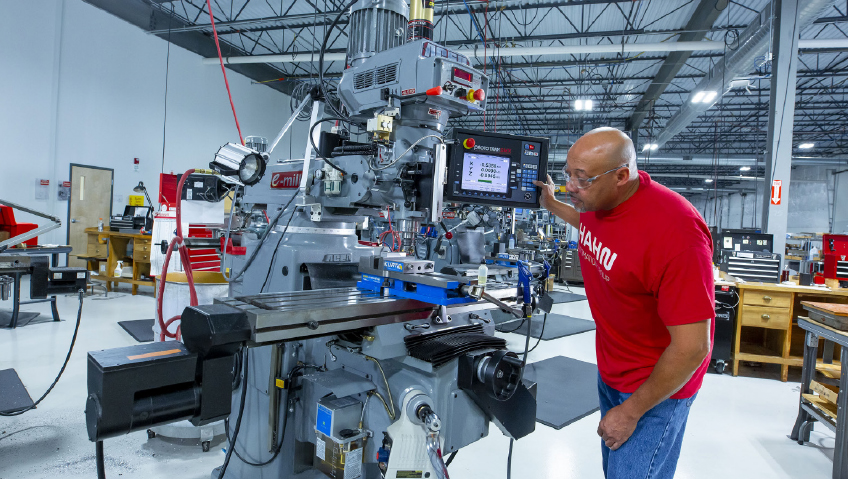

A custom equipment provider backed by a global footprint of facilities, technology, and resources, HAHN Automation Group U.S. Inc. is an expert in the design and manufacture of high-performance, integrated automation and robotics solutions for manufacturers across geographies and market sectors.

Integration is HAHN’s specialty, both for its customers and internally, and since 2024, HAHN Automation Group has operated under a unified global brand to take better advantage of the various operations under its control. Specifically in the U.S., HAHN Automation Group brings together the power of four well-known automation companies—Invotec, HAHN Automation, REI Automation, and HAHN Plastics—with over 30 years of collective experience, allowing customers around the world to benefit from shared technology, cohesive resources, and a combined expertise that truly sets it apart.

“One of the main things that’s helped us to do this is how we collaborate across our 20 locations globally so that we can assess projects and meet our customers closer to where the machinery will be in production—we can offer local support or additional resources,” explains Vice President, Commercial Management & Development, Noah Smith, who works out of HAHN’s Miamisburg, Ohio operation (previously Invotec).

With proven equipment solutions in MedTech and automotive electronics manufacturing that serve as foundational pillars of its operation, HAHN provides customers with solutions tailored to their specific industry needs while leveraging its expertise between its business units to find the right solution.

“A lot of those innovations and those technologies that automotive has developed over time are just now becoming more prevalent in MedTech, and so we’re able to use some of that historical expertise and knowledge in that field. We’ve found that it certainly does transfer to our body of knowledge of the medical market, just with some adaptation,” says Smith of the company’s internal cross-sector collaborations that have proved so fruitful.

Greg Earle, Managing Director in Hebron, Kentucky, notes that it works both ways: “A lot of things from the MedTech side—the quality systems and inspections and the testing side of things—have been adapted over to the automotive industry over time as well. Quality has always been a priority for automotive, and that experience gives us a different insight into how to validate and check things,” he says.

Both the MedTech and automotive electronics sectors have processes and operations that would benefit from automation solutions like those offered by HAHN Automation Group U.S. Inc. On the automotive electronics side, opportunities run the gamut from automated assembly and test processes to machine integration, tending, retooling, and retrofitting.

“In Hebron, we’re trying to grow our service department, and that means a lot of things,” Earle explains. “Some of our small, very dynamic projects, at the same time as growing the partnership, allow us to help when customers want new equipment. We can serve as that ‘easy’ button for ordering general spare parts, or for quick parts turnaround to keep their production going. Preventive maintenance programs, data analysis updates, and reporting-panel technologies also help our customers be prepared.”

In the MedTech sector, increased levels of automation in manufacturing has been a trend for several years, amplified by supply chain challenges. Additionally, the increasing complexity and small nature of medical devices presents a greater need for automation tools that help them meet regulatory requirements.

“Our facilities in Dayton, Ohio and Brooklyn Park, Minnesota serve as the global MedTech headquarters for the HAHN Automation Group. We don’t just specialize in MedTech manufacturing because it’s part of our portfolio—it is all we do in those locations,” says Smith. “It allows us to be intimately familiar with the challenges of medical device manufacturing and structuring equipment solutions for those challenges.”

Indeed, because of the company’s strong global presence, it can support its customers wherever they are and whenever they need it most—and that support comes in many ways.

“We’re able to work within a lot of our customer partners’ global structures to develop agreements or standardized processes for them that they can roll out across multiple plants and thus implement technology at a quicker pace,” explains Smith.

This support is ever more important given the rate of technological advancement associated with progressive automation. The advantage of being part of a larger entity is having dedicated resources, advanced technology, and research and development departments that are working with technology and component suppliers to remain on the cutting edge of available technologies and solutions.

“The company’s size and its investment in these capabilities have enabled it to support larger projects for larger customers than ever before. Yet, for the company just starting out, HAHN has solutions too,” says Smith.

Earle draws attention to machine-tending applications as a good starting point for companies considering automation for the first time. “They keep those machines—in which they have a lot of capital investment—running more continuously and more often, maybe even for a 24-hour day or on a lights-out operation, to get their return,” especially when skilled talent is scarce.

While demand for talent exists across sectors, things operate differently in MedTech than they do in automotive electronics given the relative maturity of automation and production levels between the two. Certainly, automotive has a long history in automation, the value of which is just beginning to be recognized by MedTech. From Smith’s perspective, “to just start to understand what the benefits are of operator-assisted automation or higher levels of semi-automation that lean cell technologies offer you, consider, for example, that we were in a site last week that had over 12,000 employees in one production facility, and 80 percent of those were operators, which is not a sustainable method.”

He adds, “As the products get more complex, you’re counting on operators to inspect and uphold quality standards while, at the same time, going through repetitive motions and tasks. The human is not designed for consistency like automation is.” In MedTech, the problems arise even before machine-tending, he notes: “It’s a matter of taking manual processes and trying to improve consistency, quality, and output.”

Given the focus on assembly, inspection, and testing, some of the greatest opportunities in MedTech are in cameras and vision systems, particularly as the number of operators doing manual inspections is still relatively high in a tech-enabled space.

“That facility that I mentioned with 80 percent operators has 40 to 50 percent of those doing manual inspections under magnifying glasses or magnifying lenses in those vision systems that don’t have AI. AI vision really helps to teach a computer or human what they’re looking at so that those actions can become processes rather than just operator-dependent inspections,” Smith explains.

However different each segment is, they are bound by a commonality of processes and relationships that are strengthened by a company culture that permeates the global footprint. “We strive to reach that point where we don’t look at our vendors and distributors as just vendors and distributors; we consider them as partners just as we do with customers. Trying to advance quality and technology while working together is more of a partnership, and that’s what we focus on as part of our core values,” says Earle.

The goal moving forward is to continue to expand these services across North America and Asia to take advantage of the growth in automation, including rapidly advancing AI, virtual and augmented reality offerings, and taking what was once “bleeding edge” and normalizing its integration into automation for customers.

One advancement that has exponentially improved the value proposition to customers is “digital twin” work that enables people like Earle to, as he himself puts it, “run the automation during the basic code generation, development, and testing and see how it all interacts together in the digital work, which hopefully speeds up the overall build time.” Instead of designing, building, and then testing, these activities can be performed digitally to intervene earlier in the process and mitigate any issues before production takes place. As Earle notes, “Digital twin doesn’t catch everything, but it could catch maybe 60 percent.”

Through these efforts, HAHN is continuing to leverage the strength of its omnipresent global footprint to provide integration solutions to its customers by aligning its best-in-class expertise, capabilities, and resources to stay nimble, agile, and ahead of the ever-changing standards for quality, innovation, regulation, and technology. For Smith, “We’ve been in operation as a group and with most of our current entities for over 30 years, which creates partnerships, and the partnerships allow us to grow with our stable and long-term customers. Those are our opportunities to support their business and grow with their business as well as bring new technologies to them and help them be successful.”

“And with our global collaboration and our internal systems, as we come together, we’re integrating all this knowledge from all the different facilities, and we need to keep expanding and growing it. It gives us a lot of power to have different concepts and ideas from a global perspective that we can bring into the facility to each of the locations when we’re working local to local,” says Earle.

There’s no doubt that this approach will continue to provide HAHN’s competitive advantage as it grows its presence and impact around the world through its highly innovative, integrated solutions.