Change and innovation are written on the bones of the manufacturing industry, and on human progress for as long as we can look back. Simple tools, then machines, and now computers have been replacing manual labour to improve efficiency, productivity, safety, and output. Through these changes, it sometimes seems like the new is always better than the old, and that manufacturers need to jump to grab the next new technology to stay competitive.

Now, with the rise of Industry 4.0, manufacturing is at crossroads once again. We have machines with a level of connectedness never seen before, and computer intelligence guiding more decisions with faster reactions, using more data than a human can consider. And, like any transition of this magnitude, it comes with a breadth of challenges, as new equipment requires new skills and often introduces new materials and processes that require training and adaptability.

This is highly characteristic of the present situation, where a dearth of skilled labour and the new demands of advanced materials and equipment are presenting new challenges across every advanced industry and sector, particularly where specialized knowledge and skills are required.

Weighing the competitive advantage

To remain competitive, manufacturers are faced with important decisions—chiefly, whether to replace legacy machines to be able to stand up to the advanced materials and manufacturing processes that are introduced. And, unfortunately, lacking the advanced equipment or the talent to operate them spells trouble for manufacturers, many of whom simply do not have the capital to integrate state-of-the-art equipment (nor does it make business sense to do so if the legacy equipment still functions).

In fact, many in-house engineers prefer legacy equipment because of the simple fact that they understand how to use it, how to fix it, and the various ins and outs of the machines that have been learned over the decades. The major downside is that older equipment is not suited for the wireless TCP/IP enabled environment and will not perform to new quality, speed, and performance standards, which means plant managers and in-house engineering teams are worried about how they can adapt to make the most of the equipment they have without outright replacement.

According to a BCG report, Sprinting to Value in Industry 4.0, more than 50 percent of plant managers are concerned about the adoption of Industry 4.0, which shouldn’t come as a surprise. Engineers in manufacturing and distribution environments can spend upwards of 70 percent of their time seeking information that could have easily been attained from Industry 4.0 advancements like the seamless sharing of information and data across the entirety of the operational system.

Why invest in Industry 4.0?

Manufacturers know that there is much to gain from the adoption and integration of the modern technology and capabilities that are afforded by the highly innovative advancements of Industry 4.0. Among the benefits of integrating these advanced value-adding technologies are demonstrable improvements to workflow and throughput, particularly in terms of reduced downtime, which means that it makes the entire operation more cost-effective and thus, profitable.

According to research by McKinsey in August 2020, manufacturers that integrate Industry 4.0 capabilities will see a 30 to 50 percent reduction in downtime, a 10 to 30 percent increase in product throughput, and a 10 to 20 percent reduction in the cost of quality.

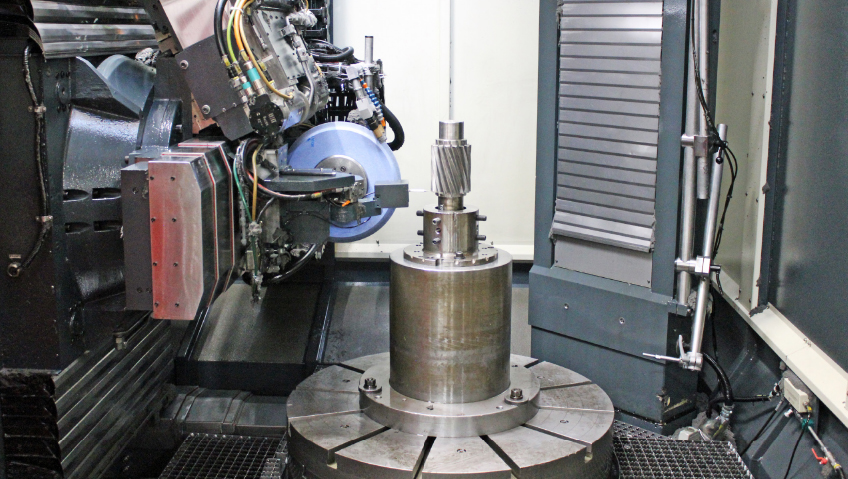

Luckily, outright replacement of legacy equipment isn’t a requirement to leverage the advantages of Industry 4.0. Some manufacturers are making investments to be a part of this digital shift, taking advantage of the collaborative, smart manufacturing equipment and systems that connect to the Internet of Things (IoT).

This not only presents an opportunity for manufacturers, but it is also an opportunity for the equipment manufacturers to address an emerging market: legacy equipment upgrade packages. Be it smart sensors, cloud computing, programmable logic controllers (PLCs), or machine learning, there are ways to take advantage of these advancements without wholesale replacement of the legacy machines that exist.

How to leverage Industry 4.0

As with many things, getting started is sometimes the hardest part. This is most definitely the case when it comes to upgrading and retrofitting legacy equipment to be Industry 4.0-enabled.

To begin, manufacturers can assess their existing machinery to identify where and what specific upgrades make the most sense for their operation. This is also a suitable time to consider compatibility between the various systems and future scalability in the context of a detailed integration plan.

Manufacturers can start by leaving existing control systems in place, using edge computing gateways in parallel to understand where it makes the most sense to install or replace PLCs, as it is fairly straightforward to add small gateway devices to old equipment, particularly if the equipment is instrumented or designed for this kind of external communication. Where this is not the case, IoT couplers can be utilized as an option.

In many cases, it makes more sense to retrofit equipment with external sensors around which IoT can be built to leverage the data collected than invest in entirely new equipment or capabilities. Sensors can monitor temperature, pressure, vibrations, and other processes.

Successfully integrating elements of Industry 4.0 with legacy equipment will require clear goals and objectives and the selection of control systems and automation technology that align with the specific needs of the operation. The investment needs to make sense for your operation, because over-retrofitting is a possibility—as is too much data, which can result in data paralysis whereby the information is not being used for the operation’s benefit.

It is best to begin with retrofitting one process at a time, starting small by considering things like asset tracking or better understanding the cyber-physical systems that process the information that is being gathered more quickly and efficiently for immediate availability for the benefit of improved productivity, profitability, and safety.

An assessment of existing digital outputs can help to establish a baseline that can be measured, from which a step-by-step integration plan can be implemented, including training and related affairs that will position the operation to take full advantage of the IoT-ready operation and the data being collected via the digitization of the communication between machines and modern hardware and software. The insights that are derived help to identify and mitigate bottlenecks and process improvements—things like condition-based monitoring or predictive maintenance versus reactionary or scheduled maintenance.

Likewise, by leveraging data from existing systems and operations, manufacturers can improve performance, efficiency, and output, and it gives them the capacity to add additional sensors or automated technologies in the future.

An emerging market

With the emergence of Industry 4.0 came a new demand for these retrofit and upgrading services, a market phenomenon that has been referred to as ‘servitization,’ or the emergence of a service offering, particularly for equipment OEMs.

By retrofitting legacy equipment in the context of technological advances to enable them to remain relevant and competitive, operations can save money and create new market opportunities, adding added-value features to existing service repertoires and creating and capturing value through the deep knowledge and technical competencies they possess on the legacy machines and how they function.

Typically, however, retrofits rarely involve OEMs, so while there are a few manufacturers that are taking advantage of this market by introducing sensor packages and related services, others are not because, like the companies they serve, they lack the capacity to expand the scope of their services.

OEMs, too, are faced with talent shortages and adding demand to already tapped-out resources has the propensity to create new bottlenecks in industry, as these teams will be responsible for the installation of new equipment as well as servicing legacy machines. The sheer number of retrofits that will need to be done in the U.S. alone is staggering.

This can have a ripple effect throughout the entire manufacturing sector with potential for delays in repair/installation as demand puts a strain on the companies who build, repair, and install. This could lead to bottlenecks for equipment and service and can delay production cycles and challenge profitability. Downtime costs money, and in a highly competitive market, can spell certain doom.

Other challenges that present themselves for manufacturers who are retrofitting equipment are related to security. Increased connectivity without adequate security can be a liability for some companies that are trying to protect proprietary data—another expense and another layer of concern for operations to consider.

A paradigm shift

The integration of Industry 4.0 also requires a restructuring from a cultural and structural standpoint, as many traditionalists are resistant to modern technologies regardless of the inevitability of its adoption. A failure to adapt will almost certainly limit opportunity to succeed.

Manufacturers will have to adapt, and adaptation can mean the smallest of changes. In fact, it is advisable for them to start small and change incrementally to not overwhelm an operation. This requires continued investment of time and attention including rigorous testing to ensure that things are operating optimally, which can ultimately become a system of continuous improvement from which the operation can continue to evolve to remain competitive as technology continues to advance.

The overarching goals should be to remove the single points of failure in any process; remove or update the electronic control components that are no longer functioning or need replacing to increase plant uptime (and thus, reduce downtime); lengthen equipment lifespan, efficiency, and reliability; and collect data that can be analyzed and leveraged for efficiency. With some smart upgrades, we can often give legacy equipment a new lease on life for maximum return on investment.

There is also something satisfying in doing so. Emotions shouldn’t get in the way of smart business decisions for manufacturers, but perhaps we can indulge in attributing value to the nostalgic feel of equipment that has weathered more years. By keeping something old and reliable running on the factory floor with a few upgrades to keep it relevant, we can perhaps enjoy the familiarity of tradition without compromising too much on the competitive advantage of advanced technology and innovation.