President Trump is sparing no one from the impacts of his tariffs, as he has expanded steel and aluminum tariffs to all countries effective March 12, 2025. On February 10, 2025, the President issued two proclamations: Adjusting Imports of Aluminum into the United States and Adjusting Imports of Steel into the United States, which modify the tariffs originally imposed in 2018 under Section 232 of the Trade Expansion Act of 1962.

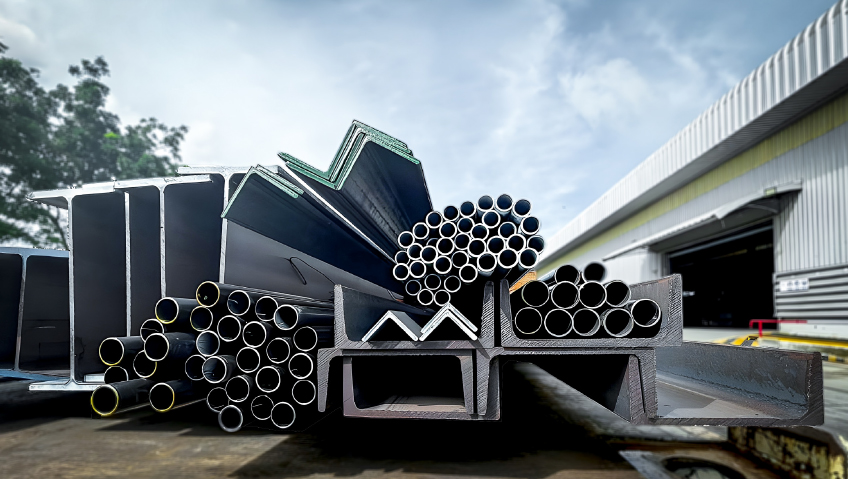

Since that time, the United States has maintained a 25 percent tariff on steel imports and a 10 percent tariff on aluminum imports, but in 2020, Trump expanded the tariffs to cover certain derivative products.

Prior to the proclamations, the tariffs were subject to a product exclusion application process, as well as General Approved Exclusions (GAEs). Now, all current quotas, tariff-rate quotas, national exemptions, GAEs, and the product-specific exclusions application process have come to an end, including existing exemptions on imports from Argentina, Australia, Brazil, Canada, the EU countries, Japan, Mexico, South Korea, Ukraine, and the United Kingdom.

These countries will now be subject to 25 percent tariffs on aluminum and steel, including downstream steel and aluminum products, though an exemption process has been established for imported derivative articles made from steel that is melted and poured and aluminum that is smelted or cast in the U.S.

The changes apply to products that are entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. Eastern Standard Time on March 12, 2025. The President has noted that he is open to discussing new national exemptions before that time. It is likely that retaliatory measures from other countries will follow, though none have been announced at the time of writing.

The proclamation on aluminum will see the tariff rate rise from 10 to 25 percent for all countries, with one exception: Russia. Imports of derivative aluminum articles or those using primary aluminum smelted or cast in Russia are subject to a 200 percent duty rate, “in addition to any other duties, fees, exactions, and charges applicable to such imported derivative aluminum articles.”