As varied business sectors worldwide deal with myriad issues following the COVID-19 pandemic that continue to be felt today, one area that continues to see both growth and innovation is that of the maritime industry, specifically in the realm of shipbuilding. Across several of the world’s most formidable and developed countries, the development, production, and launching of new waterborne craft is still an important part of the global economy.

The good news for the global maritime market is, thankfully, readily apparent. According to the Shipbuilding Market 2024 Report, shipbuilding worldwide is anticipated to rise for the rest of this decade as the market continues to grow steadily. While China leads the pack with about 40 percent market share, South Korea is not far behind at 35 percent. Among the top shipbuilding companies are names like the China Shipbuilding Group Corporation, KSOE (Hyundai Heavy Industries), and Daewoo Shipbuilding, among others.

A report for BRS Shipbrokers says that, currently, China is the leader in the global shipbuilding market and has been for over a decade now, with even more growth occurring post-pandemic. China’s shipyards are anticipated to stay strong for the remainder of the decade as demand persists for newer vessels as well as ones made from low-carbon materials. When it comes to South Korea, Brian Gincheru Kinyua for The Maritime Executive says that the country’s shipbuilding efforts were supported by the government between the 1960s and the 2000s, enabling rapid production during times of slowdown for other countries, a trend that continues today.

Over on the western front, North America is seeing considerable differences in fortune between two of its major countries. Canada’s efforts in shipbuilding have been driven by the National Shipbuilding Strategy, a long-term initiative to revitalize the industry and produce greater economic benefits to the country at large. Following over a decade of slowdown for the sector, as well as an outdated roster of ships and inaccessible supply lines, the federal government implemented the strategy in 2010. It has been focused on the construction of large vessels (1000 tons and over), small vessels (under 1000 tons), and the repair, refitting, and maintenance of vessels.

The strategy has seen great success so far, thanks to placements like the Irving Shipyard in Halifax, Nova Scotia. In a press release in late 2023, Vice President of Production Nancy Lochhead reported that the quality of the shipyard’s work has improved greatly. “Our first-time quality standard, which stood at 80 percent in 2020, has soared to an outstanding 97 percent across all disciplines in 2023.” Lochhead also shared that safety performance has exceeded industry benchmarks by over 50 percent and injury rates have decreased by 13 percent, which has further emboldened workers in the industry.

Despite its best efforts, Canada’s shipbuilding industry was one of the many sectors affected by the COVID-19 pandemic and, while it is beginning to recover, there is still a degree of volatility to the market that could prove challenging as time goes on. Meanwhile in the United States, the outlook is a bit less positive. In an article for McKinsey & Company, authors Weddle, Cassaday, Mellors, Brukardt, Voelker, and Plum say that overall shipbuilding production in America has fallen to new lows because of the decline in commercial production. “U.S. shipbuilding output has decreased by more than 85 percent since the 1950s, while the number of American shipyards capable of building large vessels has fallen by more than 80 percent.”

However, mainstream customers of the industry like the U.S. Navy are continuing to spend, calling for the construction of over 300 new ships by 2053, so time may be a crucial factor in producing a turnaround for the country’s shipbuilding fortunes.

Shipbuilding is one of many business sectors globally that are beginning to embrace new technologies and changes to the old ways of doing things. Ben Hayden for WorkBoat says that some of the newest trends for shipbuilding will be the use of VR (virtual reality) and AR (augmented reality) technology. These technologies will enable interaction with ship designs in virtual environments through realistic simulations and tests, which can also help develop new training and safety protocols. OMS (Optimum Maritime Solutions) is one such company employing the use of VR for training purposes, while Finnish company Wartsila is innovating the use of wearable AR gear as a form of preventative measure for ship operations.

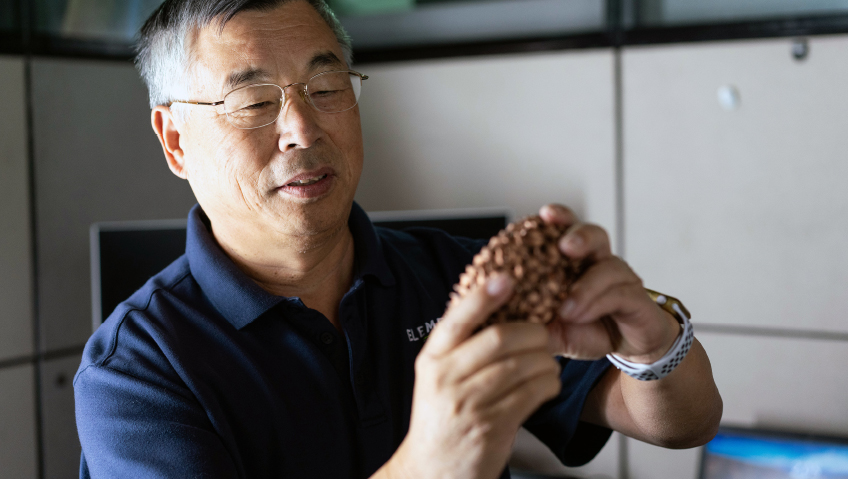

StartUs Insights reports that advanced robotics are also on the rise for the industry, especially as automation picks up in global construction markets to aid workers and speed up lead times. This movement includes companies like MarineLabs, which announced this year that the largest investment in Canadian history for an ocean tech company was made for its round of seed funding, a figure of $4.5 million.

A report for the website SeaSpan says that this investment will, among other things, be directed into the company’s CoastAware product, which is real-time weather intelligence technology that provides accurate and timely weather condition data. SeaSpan says that a product like CoastAware will not only benefit the shipbuilding industry from a logistical standpoint but also continually combat and circumvent the effects of climate change on today’s oceans.

Another newer method for companies to better predict and understand ongoing environmental factors in shipping is using AI (artificial intelligence). Although a controversial subject for some industries, shipbuilding startups are looking to leverage the use of AI in predictive analysis of weather patterns, ocean environments, and traffic management in shipyards.

AI can even help to promote a greater degree of ecologically sound developments for ships, including algorithms that can optimize fuel usage and improve route planning, making sure that ships only use as much as needed for a given assignment. Chinese company Clearbot is one such that uses ESG (Environmental, Social, and Governance) metrics to monitor and improve environmental sustainability goals in the industry with AI tools.

Indeed, sustainable practices are also becoming a growing factor in shipbuilding as organizations across all kinds of industries work to meet the expectations of clientele that are environmentally minded. A report for Spherical Insights says that green shipping is the name for this up-and-coming market trend: “Green shipping focuses on environmentally friendly transportation, warehousing, and distribution to minimize environmental impact.”

Many startups in the industry aim to develop alternative clean fuels as well as other renewable energy solutions so that today’s ships can significantly reduce the risk of environmental pollution. U.S.-based company Amogy has developed an energy system that runs on ammonia for fuel, while Fleetzero is looking to introduce zero-emission electric container ships into the fleets of today.

The ongoing development and improvement of the shipbuilding industry is on the minds of many as the decade rolls on, especially amid eye-catching news items like the 2021 Suez Canal tanker incident and the ever-looming spectre of the climate crisis remaining fixed in the minds of many worldwide. Although not every issue or problem can be predicted or outright taken care of with immediacy, shipbuilders worldwide are using novel and exciting ideas to propose solutions to age-old problems as the industry continues to gain steam and become recognized as an essential spoke on the wheel for some of the biggest players on the world stage.