When faced with challenges, businesses have a choice: either go along for the ride or grab the wheel, steer through the storm, and react minute-by-minute to changing conditions. For much of 2025, the storm has been tariff threats, which have dominated the headlines, grabbing attention on both sides of the border.

In an executive order signed on February 1, President Trump levied 25 percent tariffs on all products save for critical minerals, potash, and energy, at 10 percent. The justification at the time was national U.S. security and—according to the White House—“to address the flow of illicit drugs across our northern border.” The White House did not mince words about guns, gangs, and cartels, challenging Canada’s decades of friendly relations with the U.S.

Since February, Trump’s position on tariffs has changed almost daily. Following threats of a 25 percent tariff on non-American automobiles and auto parts, his stance softened slightly at the end of April, applying only to parts not compliant with CUSMA (Canada-United States-Mexico Agreement) and non-U.S. portions of assembled vehicles. In another bombshell, Trump doubled tariffs on steel and aluminum imports from all countries, to 50 percent. With Canada the top supplier of aluminum and steel to America, this perturbed and confused many in the Canadian industry, including Neil Rasmussen, president of Bri-Steel Manufacturing.

Navigating highs and lows

Company President Rasmussen has experienced many highs and lows in the steel industry over the past three decades. During that time, the world saw a downturn in the early 2000s following the burst of the dot-com bubble and COVID-19-related chaos, including supply chain disruptions and work stoppages. As challenging as these issues were, the present tariff situation more closely resembles a game of speed chess, except the rules are constantly changing.

However, instead of sitting and awaiting President Trump’s next move, Rasmussen is out there advocating for the industry online and in person. He has been to Washington, D.C. at least six times in the last three months, meeting with senators and congressional representatives, the Department of Commerce, and the Office of the United States Trade Representative (USTR).

For Rasmussen, championing the steel sector is not new—having made appearances on BNN Bloomberg and other programs to discuss tariffs in the past—but this time, things are different. For all his efforts, he says there is no real mechanism to help, because even if his advocacy becomes part of a bill, it still has to go to Trump for sign-off.

“I just need an audience with him [President Trump], because I think he’d understand. It takes time to build factories, and we want more new factories here,” says Rasmussen, who also actively posts on LinkedIn about tariffs, clean energy, oil and gas, and steel exports. “We want more new production here; we don’t want less production, or no production. We are good at making raw steel, but not good at making products—not as good as the Chinese, anyhow. We should be taking advantage of them and their technologies, buy it all up, and set up all sorts of factories around here right now.”

Calling the present tariff situation unpredictable is an understatement, with wild drops in the markets, and Rasmussen believes actual discussions with steel industry experts are the way forward. “It damages the markets too much, and the whole perception out there is [one of instability]; it makes you feel unstable. And when you are investing billions of dollars in these new refineries and petrochemical plants and power plants, you want stability when you’re costing.”

Facilities in Canada, U.S.

Bri-Steel is North America’s top manufacturer and distributor of large diameter steel pipes, used by customers in oil and gas, energy, resources, construction, civil engineering, and architecture. Long-established in Edmonton, Alberta, the company opened a second North American Thermal Pipe Expansion (TPE) mill in Enid, Oklahoma a few years ago.

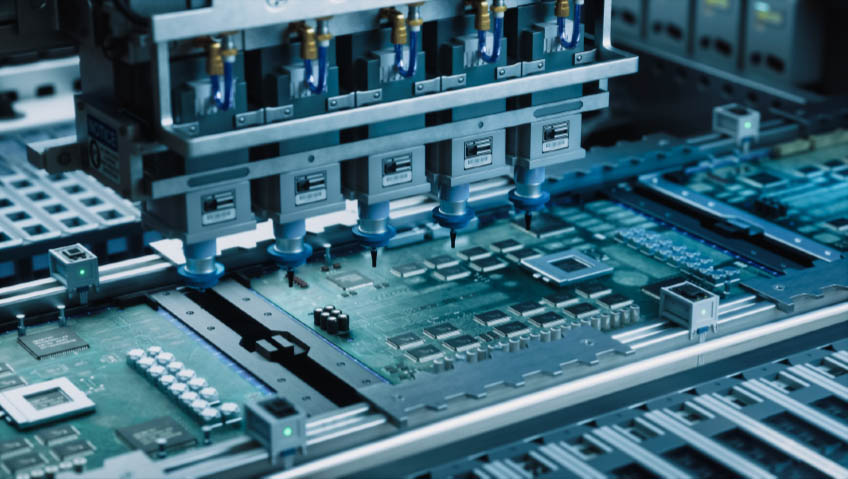

Unlike some steel mills negatively affected in recent years, Bri-Steel slowed its production but kept going during the pandemic. Realizing the company needed more capacity led to Rasmussen’s investing in the creation of a second plant in America. In searching out different locations, Enid was at the top of the list. Representing millions of dollars in investment, the Enid location has the latest manufacturing equipment and technology, says Rasmussen. This will see Bri-Steel continue improving its industry-leading line of products, including seamless carbon steel and alloy steel pipe 12” to 36” in diameter, with a wall thickness of up to 3”.

Up and running since January 2025, the new facility is massive—about 330,000 square feet on 46 acres. Fully renovated, the second location has room to grow. “This facility has enough infrastructure for future expansion and provides the company with multiple options to produce a hyper-efficient factory that can survive even the worst of times,” according to a January 2023 media release.

The new location will continue producing to meet all major industry standards, will continue with its API Q1 (American Petroleum Institute) quality system, and will expand on the Monogram program. The new site is near colleges and an Air Force Base, making it easier to hire its team of 76. “There are lots of quality people to choose from,” says Rasmussen. “It’s been a great experience coming down here; they are very business-friendly.”

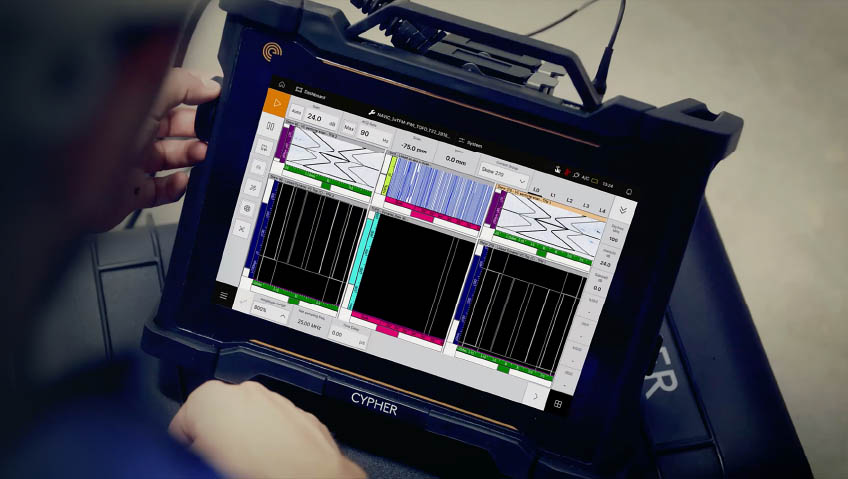

The location essentially duplicates the company’s original Alberta site and includes two lines of thermal pipe expanders that can handle 12” to 36” diameter seamless pipe, new blasting machines, ultrasonic and hydrostatic testing equipment, full labs, and more. “Everything to make the pipe and finish the pipe, it’s all here,” Rasmussen says. “It’s a nice-looking operation.”

By comparison, the cost of getting more power into Canada was greater than the entire U.S. facility. Best of all, there is room for more staff, machinery, and production. “We have had such positive feedback from the people in Enid, and the State officials have been excellent to deal with,” said Rasmussen in a press release. “We are excited to bring back 12” and larger seamless pipe manufacturing to the USA and to fill the void left behind by US Steel. This is a true Southern Expansion!”

The need for stability

Along with tariff chaos, Rasmussen says Canada’s federal government needs to shape up. Another issue is the TRQ, tariff-rate quota, an often-confusing, two-tiered tariff system. Some issues encountered by Bri-Steel include incorrectly entered tariff codes. Rasmussen has tried to give officials a system, but they don’t have the people or resources to understand it well enough, another source of frustration.

“From 2024 to 2025, the amount they are allowing in on their quota system is around 50 percent of what the market needs to consume,” he explains. The company needs steel tubes to make its pipes, and the tubes have to be imported. Bri-Steel is lumped into the TRQ, and there is only one seamless pipe mill in Canada—Algoma Tubes in Ontario, which makes 2”, 3”, 4”, and 6” diameter products. “They can’t supply the market with what it needs, and when you completely block out 50 percent of the supply, what’s going to happen to the country?”

Owing to constantly changing tariffs and the TRQ, it can be hard to even generate quotes. Some clients are holding off on projects and just maintaining their systems. “It is stalling and stagnating growth in Canada,” Rasmussen tells us from his Oklahoma office. “We are at a point now where we are looking at investing another $30 million down here to build our own raw materials, to be able to supply ourselves with tubes out of the domestic steel—because with our product, it comes from a billet that goes to a mill, then its heated and there’s a hole through it, a hollow, then we take those hollows and expand them into pipe dimensions. There’s no mill here that does that middle section in Canada or the U.S.”

Paying between $900,000 and $1 million every month in tariffs alone may prompt Bri-Steel to invest even further in its American operations, which recently achieved API certification.

Pipe Tools app

Along with regularly updating its website, blog, YouTube, and other social media, Rasmussen regularly posts on LinkedIn. Another tool is the company’s free Pipe Tools app, available at https://apps.apple.com/us/app/pipe-tools/id372454624.

In the process of being updated, the app is ideal for salespeople, engineers, oilfield workers, pipe purchasers and others to create accurate estimates. The idea was born when Rasmussen had a conversation with a customer in Tennessee who was confused by price per meter, per foot, and by ton conversions. “There was nothing like that on the market at the time,” says Rasmussen of the app, which will also see a new release on Google. “We were the first ones out of the gate with such an app, and a lot of others are trying to duplicate it in different ways. We’re going to put some AI components in the updated version, and it’s going to be terrific.”

Although the present tariff situation is certainly challenging, Rasmussen looks forward to growing Bri-Steel, adding more production and further product offerings. “A year from now, I plan to be in full construction at the new facility,” he says. As the industry navigates ever-changing waters, we look forward to seeing what else Neil Rasmussen and Bri-Steel have up their sleeves in the years to come.