American building product manufacturer MRI Steel Framing was founded in 2004 by its two owners, Frank Eberwein and Bill Wilson. The two had been involved extensively in the steel slitting industry and were partners in a Midwest toll processing company. MRI Steel Framing started with one light-duty roll-former capable of producing only non-structural framing members at seventy feet per minute. Very quickly, MRI realized the need for more machinery and purchased the most advanced roll forming equipment on the market to facilitate a rapidly growing customer base.

Within its first year, with this advanced equipment, the company went from offering only nonstructural framing products across two gauges to offering nonstructural, structural, and accessory framing products across eight gauges at speeds of three hundred feet per minute. It also expanded to a second location, allowing space for its first truck in what would become a formidable fleet.

Eventually, the company strategically moved from its initial location in Bensenville, Illinois, due to expansion by the nearby O’Hare Airport, in favor of a location in Gary, Indiana next to the owners’ toll processing company. This move gave MRI more space at a lower cost and greater proximity to its partner organization. In the past few years, with the support of the founders and, beginning in 2019, two private equity firms, the company grew even further, by adding considerable resources that fueled its expansion to this day.

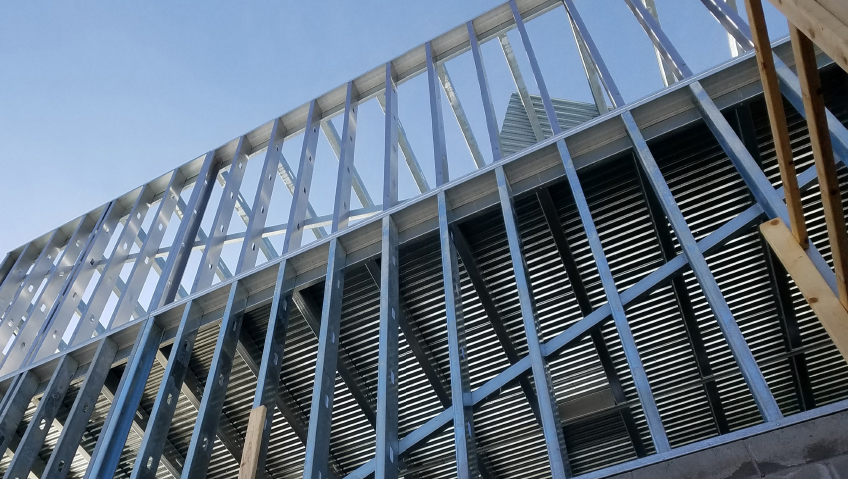

Over the years, MRI has grown by purchasing more trucks and more machinery and increasing its product range. Its products are used in the construction of multi-family housing, data centers, hospitals, and warehouses.General Manager and Vice President Mark Krzyszton observes that there are many booming sub-industries within the construction space, and the company still has a good amount of commercial housing projects, as well as partnerships with various customer types in different regions. The company has strategic alliances with large contractors and sells products to nationwide distribution yards, panelizers, and even other framing manufacturers in the country.

What matters to MRI are the people who will end up working with the products. “If the end user is happy with the product and the service, then everybody is happy. We strive to go the extra mile with our order accuracy, product packaging, and quality. We want to solve problems and manufacture products that are easy and efficient to work with,” Krzyszton says.

The flexibility of its machinery and how it goes to market is what makes MRI stand out in a field as dense as construction. Vice President of Sales Larry Hybert asserts that all the company’s equipment is high-speed and technologically outperforms anything else on the market. The flexibility of these pieces allows for quick reaction to the custom orders called in by its customers, and MRI’s proximity to its sister company that processes steel coil makes it much more efficient than other manufacturers with practically no transportation time.

“We can go from product to product within fifteen seconds,” Hybert explains. All the equipment can adjust automatically with very little need for tooling change outs.

MRI also sports its fleet of trucks, which has allowed it to offer optimized service. Krzyszton estimates that 85 percent of the company’s deliveries are made on its fleet, which is a competitive advantage. Punctuality in logistics and delivery is paramount in the projects with which the company involves itself, and late delivery can cost the end user a fortune in labor and equipment costs. It even offers smaller trucks outfitted with Moffett portable forklifts for more specialized deliveries. Combined with its regular fleet, this provides a definite advantage in serving customers.

Internal developments in company software have also spurred development. Krzyszton mentions that a new enterprise resource planning software implemented in late 2017 has allowed better tracking of inbound material as well as greater flexibility in production scheduling, effectively streamlining the entire business. Within only a month of implementation Krzyszton recalls MRI having its biggest shipping sales period and the massive operational benefits provided by the new ERP software.

Around the same time, MRI added another new roll-former to its repertoire that was the first of its kind in North America to be able to roll form four-inch flanges. Although products like this are uncommon, purchases like the roll-former allow for production flexibility and keep customers happy and bring the business closer to its goal of becoming a one-stop shop for its clientele.

Equivalent nonstructural framing products, or EQ products, have become a rising material in the areas of construction within which MRI does business. EQ framing products are designed to meet the same performance metrics as traditional framing products but are manufactured with lighter and stronger steel. The company has recently introduced two 20-gauge EQ products to its lineup to offer customers purchasing flexibility. Hybert describes EQ as a game-changer for the company as the material has become roughly around 90 percent of the nonstructural framing marketplace today.

Although initially a niche product, EQ has since opened a massive new customer base for MRI. The important thing in marketing these new solutions was to educate customers on both their proper use and application. EQ is not suitable for every job but has a definite use in steel construction, which has led to its misuse in certain applications. Currently, the company sells two types of 20-gauge EQ framing products, which gives the customer even more options for whatever needs they have, something that has helped both sides tremendously so far.

The construction industry is undergoing its fair share of ups and downs in 2022. Currently, issues with labor shortages, supply chain disruptions, and inflation are making the construction process more difficult. Krzyszton and Hybert note that 2021 was a chaotic year filled with uncertainty due to domestic steel shortages and rapidly rising steel prices.

Although the industry seemed to be closer to settling down this year, recent turmoil in Europe has created more uncertainty in the steel industry and has made chaos linger. Despite this, MRI leadership observes that construction is in a strong position for the year.

The company is in the middle of moving its operations into a new and larger facility to open more options for additional roll forming equipment and production automation. The new production facility will allow for an estimated 25 percent greater output and will increase efficiencies by moving work to one location instead of spreading it across two. With a compressing workforce, MRI looks to set itself up more efficiently soon to retain employees with a nicer, new space while building its automation solutions.

MRI will continue to serve customer needs; chiefly, by holding its prices as solidly as possible, which will allow for a greater comfort level for the customer base. “If we can take metal framing off their plate as a worry, that’s a big plus for us,” Hybert remarks. As steel is one of the most in-demand materials for construction projects, taking care of every aspect of it on a project helps clients and the business in a mutually beneficial cycle.

The focus remains on the move, improving efficiencies, and an expected twenty percent growth for the remainder of the year – goals that are certainly within the wheelhouse of the company that has been a go-to steel framing supplier for nearly twenty years.